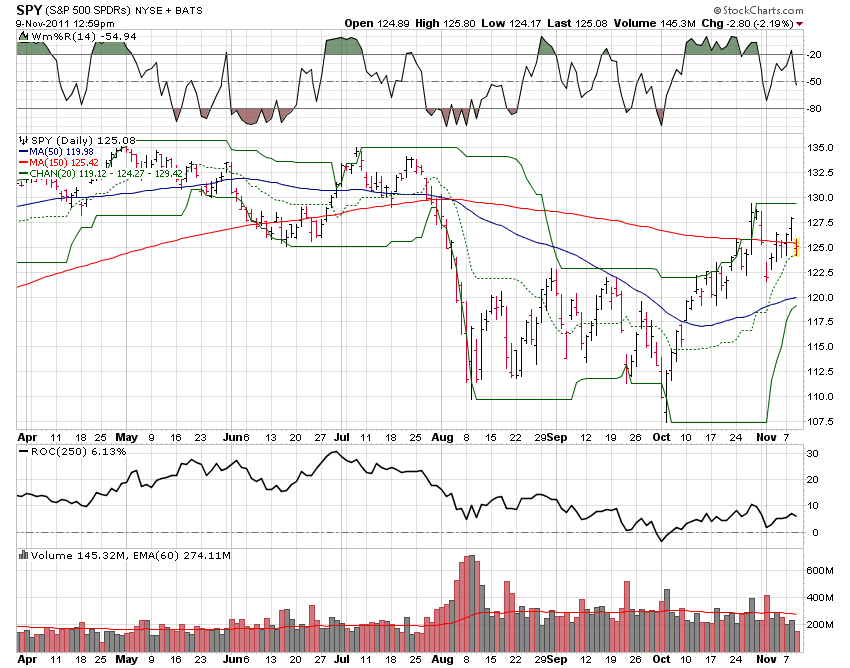

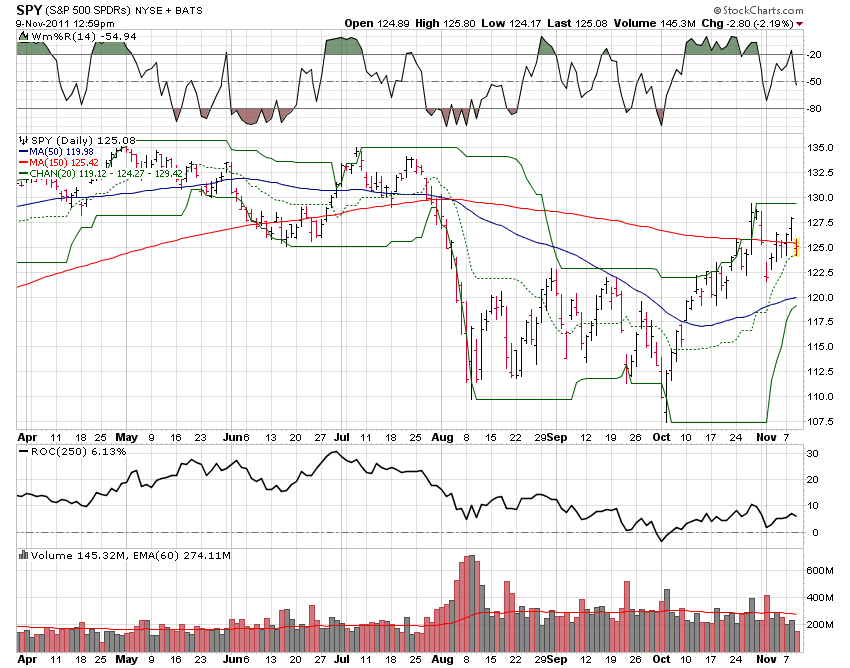

Wednesday, November 09, 2011The S&P 500 (SPY 125.00 intraday) is continuing to act top-heavy. Although a buy signal from 122.5 remains in place with a sell stop now at 119.12 (the 20-day low), as I indicated in my last post, I went flat - perhaps prematurely - because the market was not confirming its breakout.

In the latest mini-rally, the market continues to show weak volume, far lower than the volume during its massive gap-down sell-off on news of a Greek referendum which although tabled for now has been eclipsed by the far greater problem of Italy's political and debt crisis.

As always, there are some ambiguous signs, such as the ability of the market to remain (until today) in the upper half of its 20-day range, and what could be hallucinated as a wide and sloppy flag from about 122 to below 130. Seasonality is also on our side, but little else is.

What would change my mind? If the market could decisively clear 130 on heavy volume preferably and remain above it for several days. Yes, by then one would be buying at higher prices, but so what? Had you followed the simple 20-day system, you would have been in cash or short since May (I didn't take the July buy signal which led to a small loss) and the market would have to advance substantially for a buy and hold investor to catch up with a trend-follower.

In the latest mini-rally, the market continues to show weak volume, far lower than the volume during its massive gap-down sell-off on news of a Greek referendum which although tabled for now has been eclipsed by the far greater problem of Italy's political and debt crisis.

As always, there are some ambiguous signs, such as the ability of the market to remain (until today) in the upper half of its 20-day range, and what could be hallucinated as a wide and sloppy flag from about 122 to below 130. Seasonality is also on our side, but little else is.

What would change my mind? If the market could decisively clear 130 on heavy volume preferably and remain above it for several days. Yes, by then one would be buying at higher prices, but so what? Had you followed the simple 20-day system, you would have been in cash or short since May (I didn't take the July buy signal which led to a small loss) and the market would have to advance substantially for a buy and hold investor to catch up with a trend-follower.

No comments:

Post a Comment