Wednesday, March 16, 2011 (SPY @ 128.56 prior close): The economic aftermath of the human and ecological catastrophe in Japan will not be known for some time, but regardless of how cold-blooded it may appear to some, investment decisions must always be separated from emotional decisions. Our natural compassion should drive us all to help donate to charitable organizations of our choice, but of course we need to have excess income and profits to make those investments. Unless you are George Soros or Warren Buffet, the things you buy or sell do not know or care that you buy or sell them, and are generally not affected by your actions, so it is important to do what we can for the survivors while also assessing what if any changes should be made to our investment strategy based on the unfolding economic landscape.

A Personal History Lesson

It is during emotional times like these that having an anchor is critical. Prior to the first Gulf War, when oil futures were going through the roof, I called my broker at the time asking how I might be able to profit from what every analyst "knew" was going to be a continued surge in oil as a result of the inevitable protracted land war to liberate Kuwait.

My broker asked whether I really wanted to make money with oil futures. I reiterated that I did. "Then run as far and as fast away from anyone selling you those oil futures as you can!" Never trade the news, he told me, unless you want to go in the opposite direction as everyone else, and that can be even more dangerous. Instead, have a long-term, boring investment approach that ignores the inevitable craziness and horrors that will inevitably grip our planet from time to time.

I hung up thinking he was awfully boring, especially since he could have made a lot of money from commissions in those days, but he was as right as rain. A few days later, the air war began, it became evident it would be a smashing success from a military perspective and the war would very unlikely be protracted. Oil futures collapsed and hit record lows. Had I gone with my impulse as a neophyte who at the time knew nothing about how markets worked but could respond to an emotional headline as much as anyone else, the tiny money I had scraped together at the time would have been even tinier.

I learned many things from that exchange (and Marty Schwartz at Paine Webber, if you are still out there, thank you so much for that lesson!):

- Never trade the news, at least not in the obvious way;

- Never trade on emotion or impulse;

- If all the pundits say something is obvious and inevitable, they are almost always wrong;

- If everyone is thinking the same thing, no one is really thinking;

- When things are bad, they look like they will be bad forever;

- When things are good, they look like they will only get better forever;

- If you have a strong urge to make a trade, pass on it.

There are probably other lessons, but those are the ones that pop to mind.

Back to Japan

So what is the economic news from Japan? The consensus as I write this is that no one really knows, but it is very, very bad. Japan is the world's third-largest economy and a major producer of semiconductors. Although the earthquake and tsunami hit an area of the country not intensive in manufacturing, the hit to the electrical grid in a country that must import all its oil, so shifted to nuclear power years ago, but now has those plants shut down - under water or on fire (or both) will inevitably disrupt production. This will delay or disrupt production of everything from iPads to automobiles, not just in Japan but around the world.

Japan will require billions to rebuild its infrastructure. It is already deeply in debt (although unlike the United States, most of its debt is held domestically, by Japanese households, so capital flight is unlikely). Two effects of the necessary borrowing will occur: a direct increase in interest rates as money becomes more scarce; and an indirect increase in interest rates as Japan may trim back its purchases of US debt (which we issue at a billion dollars a day).

The ecological disaster from the nuclear fallout and radiation release is unclear, but the most reliable sources reassure us that it will not be a Chernobyl situation. Then again, the reactor that has the most fires was not even operating at the time of the tsunami, so my sense is that once again, no one really knows, but damage minimization mode (to avoid an exodus of foreigners and massive dislocation of the population) is probably occurring at a PR level. We will not know for months or years what is really unfolding right now, but none of it inspires confidence that the hit to the Japanese and world economies will be anything but huge.

However, since the consensus is so gloomy, is there a chance that a disciplined investor could take advantage of the panic and buy? Perhaps but this brings up another adage: "never try to catch a falling knife." Markets can fall much farther than anyone thinks and surge much higher also. There is no law that a decline must stop or that the fact prices are 25% lower or 10% or 50% than 2 weeks ago means they must revert to those levels anytime soon, or that they are not still 50% or more higher than where they should be. (This is NOT a prediction, mind you, only a reminder to avoid the emotional impulse to look at any and all sell-offs as buying opportunities. Most aren't and it only takes buying one stock aggressively at 90 (because it was 100 last week) and riding it down to 1 to wipe out decades of profits.)

What do the Charts Tell Us?

We all need our anchors. I find mine in the daily record of open, high, low, close prices and volume. The actions of millions of decision-makers, weighted for their seriousness and urgency, is reflected in what is really a sort of ECG of the health of the market.

From this perspective, Japan is in a definite sell state and should be avoided:

Any trend-follower using the system I have found most reliable over the years, the mind-numbingly system of buying the 20-day high and selling the 20-day low, would have exited the Japanese market (using EWJ as a proxy) either at 11.20 5 trading days ago, or at the very worst, at the 11.10 open 4 trading days ago (the reason for the uncertainty is that depending on market conditions, liquidity, etc., a stop maybe hit even if the printed price that shows up on the chart is hovering just above that price). Note that either of these exits would have locked in a tidy profit since the 10.2 entry in early November. Let's consider that: even in the face of a catastrophe that no one could foresee, a simple trend-following investor who found herself long during the worst earthquake in Japan's history, still would have made a profit of at least 9% in 4 months and would now be in cash waiting for things to settle down.

Expect lots of volatility with relief rallies, some stunning, and massive sell-offs, but lots of bumping and grinding, backing and filling, until the market tells us its next move.

The negatives on the chart that would have to be removed before the outlook would change would include:

- very, very, very heavy volume on down days;

- 4 gap down days in a row (the last one filled);

- long down bars with closes of each of the last 8 days lower than the high of the preceding day;

- lots of uncertainty as the market trades in a wide daily range, closing sometimes at the top, sometimes in the middle, and sometimes at the bottom of that range.

The one positive here is that the market closed near the high of its daily range, which was a huge one, indicating this could be a climax bottom, but I would bet that the low will be retested before the market surges significantly higher for good.

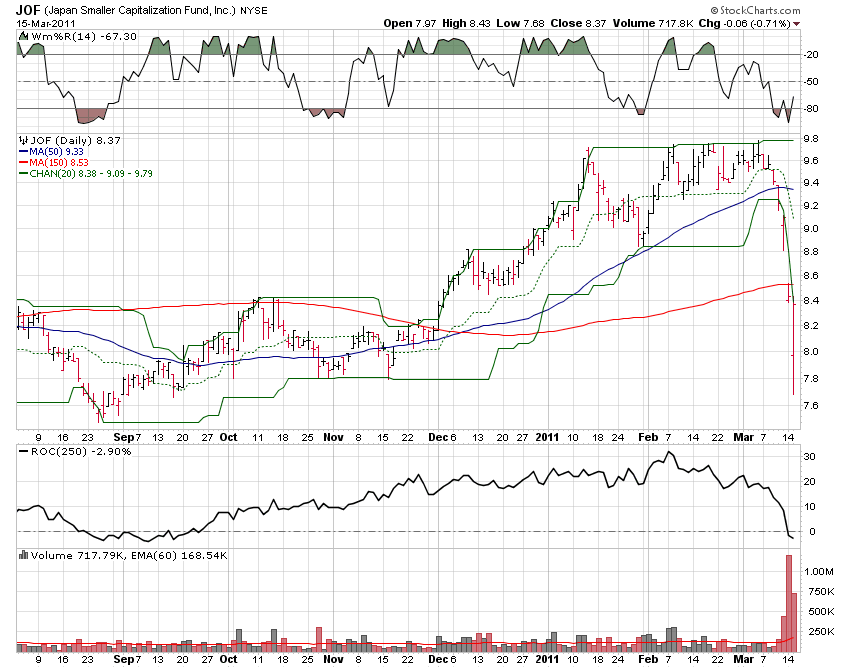

Japan Smaller Capitalization Fund (JOF) shows a similar chart, but is more volatile since it is a closed end fund, not an country ETF, so trades both on prospects for the underlying assets AND the fund itself (it can trade at a premium or discount to those assets):

The S&P 500 Triggered a Sell Signal 4 Trading Days Ago at 1300

Again, if you were following the 20-day high-low system, you should have exited the S&P 500 (I use the SPY currently at 128.56) at 130:

I must admit I cheated and exited at 132 a couple days prior to the earthquake but this was simply luck, and in general it's better to follow a system rigidly, even if it leads to somewhat worse entries and exits, than try to get cute. For every time I get out a few points higher, there are others where exiting prematurely will lead to regret.

Exiting the SPY at 130 locked in a nice profit of 20 points (18%), since the entry point was at 110 in September. The trend is your friend. No clairvoyance required.

The reasons I exited a bit early and all trend-followers should be flat now (or short if you are so bold) remain in place:

- extended advance from the September breakout (the weakest of all reasons), with an over-35% surge trough-to-peak from the late August lows;

- breaking of a long-term up-trend line connecting the August and November lows;

- much stronger down volume than up volume since late February;

- failure to exceed or even match the high both of the long down day on February 22 (which was on heavy volume and closed at its lows of the day) as well as a series of lower highs after the last 2-day rally in early March;

- violation of the most recent lows in the 130 area;

- congestion in the lower end of the recent trading range prior to the breakdown below that range;

- a close below the 50-day moving average for the first time since September.

Now, of course, the trend break is confirmed by a violation of the 20-day low on very heavy volume with failure to rally above the high of the prior trading day in any of the last 8 trading sessions. Although the market clawed most of the way back from its panic lows of the day yesterday, it still closed down over 1% on the heaviest volume seen in over 6 months.

Summary

Another vindication of trend-following. The heart-breaking images out of Japan should humble us all and compel us to give charitably, but we do not need to compound the tragedy by investing foolishly with our assets. After 9-11 many financial pundits who should have known better talked about the inevitable "patriot rally" that would (and should) ensue once the market re-opened. Of course, nothing of the kind occurred, and the steep losses that had preceded the attacks continued. The most patriotic thing we can do is invest wisely then direct some (or all) of our profits to the charity of our choice.

A Personal History Lesson

It is during emotional times like these that having an anchor is critical. Prior to the first Gulf War, when oil futures were going through the roof, I called my broker at the time asking how I might be able to profit from what every analyst "knew" was going to be a continued surge in oil as a result of the inevitable protracted land war to liberate Kuwait.

My broker asked whether I really wanted to make money with oil futures. I reiterated that I did. "Then run as far and as fast away from anyone selling you those oil futures as you can!" Never trade the news, he told me, unless you want to go in the opposite direction as everyone else, and that can be even more dangerous. Instead, have a long-term, boring investment approach that ignores the inevitable craziness and horrors that will inevitably grip our planet from time to time.

I hung up thinking he was awfully boring, especially since he could have made a lot of money from commissions in those days, but he was as right as rain. A few days later, the air war began, it became evident it would be a smashing success from a military perspective and the war would very unlikely be protracted. Oil futures collapsed and hit record lows. Had I gone with my impulse as a neophyte who at the time knew nothing about how markets worked but could respond to an emotional headline as much as anyone else, the tiny money I had scraped together at the time would have been even tinier.

I learned many things from that exchange (and Marty Schwartz at Paine Webber, if you are still out there, thank you so much for that lesson!):

- Never trade the news, at least not in the obvious way;

- Never trade on emotion or impulse;

- If all the pundits say something is obvious and inevitable, they are almost always wrong;

- If everyone is thinking the same thing, no one is really thinking;

- When things are bad, they look like they will be bad forever;

- When things are good, they look like they will only get better forever;

- If you have a strong urge to make a trade, pass on it.

There are probably other lessons, but those are the ones that pop to mind.

Back to Japan

So what is the economic news from Japan? The consensus as I write this is that no one really knows, but it is very, very bad. Japan is the world's third-largest economy and a major producer of semiconductors. Although the earthquake and tsunami hit an area of the country not intensive in manufacturing, the hit to the electrical grid in a country that must import all its oil, so shifted to nuclear power years ago, but now has those plants shut down - under water or on fire (or both) will inevitably disrupt production. This will delay or disrupt production of everything from iPads to automobiles, not just in Japan but around the world.

Japan will require billions to rebuild its infrastructure. It is already deeply in debt (although unlike the United States, most of its debt is held domestically, by Japanese households, so capital flight is unlikely). Two effects of the necessary borrowing will occur: a direct increase in interest rates as money becomes more scarce; and an indirect increase in interest rates as Japan may trim back its purchases of US debt (which we issue at a billion dollars a day).

The ecological disaster from the nuclear fallout and radiation release is unclear, but the most reliable sources reassure us that it will not be a Chernobyl situation. Then again, the reactor that has the most fires was not even operating at the time of the tsunami, so my sense is that once again, no one really knows, but damage minimization mode (to avoid an exodus of foreigners and massive dislocation of the population) is probably occurring at a PR level. We will not know for months or years what is really unfolding right now, but none of it inspires confidence that the hit to the Japanese and world economies will be anything but huge.

However, since the consensus is so gloomy, is there a chance that a disciplined investor could take advantage of the panic and buy? Perhaps but this brings up another adage: "never try to catch a falling knife." Markets can fall much farther than anyone thinks and surge much higher also. There is no law that a decline must stop or that the fact prices are 25% lower or 10% or 50% than 2 weeks ago means they must revert to those levels anytime soon, or that they are not still 50% or more higher than where they should be. (This is NOT a prediction, mind you, only a reminder to avoid the emotional impulse to look at any and all sell-offs as buying opportunities. Most aren't and it only takes buying one stock aggressively at 90 (because it was 100 last week) and riding it down to 1 to wipe out decades of profits.)

What do the Charts Tell Us?

We all need our anchors. I find mine in the daily record of open, high, low, close prices and volume. The actions of millions of decision-makers, weighted for their seriousness and urgency, is reflected in what is really a sort of ECG of the health of the market.

From this perspective, Japan is in a definite sell state and should be avoided:

Any trend-follower using the system I have found most reliable over the years, the mind-numbingly system of buying the 20-day high and selling the 20-day low, would have exited the Japanese market (using EWJ as a proxy) either at 11.20 5 trading days ago, or at the very worst, at the 11.10 open 4 trading days ago (the reason for the uncertainty is that depending on market conditions, liquidity, etc., a stop maybe hit even if the printed price that shows up on the chart is hovering just above that price). Note that either of these exits would have locked in a tidy profit since the 10.2 entry in early November. Let's consider that: even in the face of a catastrophe that no one could foresee, a simple trend-following investor who found herself long during the worst earthquake in Japan's history, still would have made a profit of at least 9% in 4 months and would now be in cash waiting for things to settle down.

Expect lots of volatility with relief rallies, some stunning, and massive sell-offs, but lots of bumping and grinding, backing and filling, until the market tells us its next move.

The negatives on the chart that would have to be removed before the outlook would change would include:

- very, very, very heavy volume on down days;

- 4 gap down days in a row (the last one filled);

- long down bars with closes of each of the last 8 days lower than the high of the preceding day;

- lots of uncertainty as the market trades in a wide daily range, closing sometimes at the top, sometimes in the middle, and sometimes at the bottom of that range.

The one positive here is that the market closed near the high of its daily range, which was a huge one, indicating this could be a climax bottom, but I would bet that the low will be retested before the market surges significantly higher for good.

Japan Smaller Capitalization Fund (JOF) shows a similar chart, but is more volatile since it is a closed end fund, not an country ETF, so trades both on prospects for the underlying assets AND the fund itself (it can trade at a premium or discount to those assets):

The S&P 500 Triggered a Sell Signal 4 Trading Days Ago at 1300

Again, if you were following the 20-day high-low system, you should have exited the S&P 500 (I use the SPY currently at 128.56) at 130:

I must admit I cheated and exited at 132 a couple days prior to the earthquake but this was simply luck, and in general it's better to follow a system rigidly, even if it leads to somewhat worse entries and exits, than try to get cute. For every time I get out a few points higher, there are others where exiting prematurely will lead to regret.

Exiting the SPY at 130 locked in a nice profit of 20 points (18%), since the entry point was at 110 in September. The trend is your friend. No clairvoyance required.

The reasons I exited a bit early and all trend-followers should be flat now (or short if you are so bold) remain in place:

- extended advance from the September breakout (the weakest of all reasons), with an over-35% surge trough-to-peak from the late August lows;

- breaking of a long-term up-trend line connecting the August and November lows;

- much stronger down volume than up volume since late February;

- failure to exceed or even match the high both of the long down day on February 22 (which was on heavy volume and closed at its lows of the day) as well as a series of lower highs after the last 2-day rally in early March;

- violation of the most recent lows in the 130 area;

- congestion in the lower end of the recent trading range prior to the breakdown below that range;

- a close below the 50-day moving average for the first time since September.

Now, of course, the trend break is confirmed by a violation of the 20-day low on very heavy volume with failure to rally above the high of the prior trading day in any of the last 8 trading sessions. Although the market clawed most of the way back from its panic lows of the day yesterday, it still closed down over 1% on the heaviest volume seen in over 6 months.

Summary

Another vindication of trend-following. The heart-breaking images out of Japan should humble us all and compel us to give charitably, but we do not need to compound the tragedy by investing foolishly with our assets. After 9-11 many financial pundits who should have known better talked about the inevitable "patriot rally" that would (and should) ensue once the market re-opened. Of course, nothing of the kind occurred, and the steep losses that had preceded the attacks continued. The most patriotic thing we can do is invest wisely then direct some (or all) of our profits to the charity of our choice.

No comments:

Post a Comment