Monday, March 21, 2011 (SPY @ 127.76 as of Friday's close): The sell signal continues to be confirmed in the S&P 500 as evidenced by:

- failure to rally up to the break-down point, then closing on the lows of the day when this area was approached;

- much lower volume on the two past up-days than during the prior 2 down days; this trend of higher volume on down days than up days (indicating distribution or selling) has been occurring since late February;

- failure to rally to the mid-point of the 4-week trading range (dotted green line below);

- failure to approach the 50-day moving average, and 6 closes below over the past 7 trading sessions.

Where in the world looks interesting right now? The Euro (FXE) has been breaking out after consolidating in the upper part of its trading range following a breakout at 134 in mid-January. The gap up is very bullish, although volume is not overly impressive. A key test will come in the 142 area, the site of a spike high and stalled rally in November (a bull trap):

FXE's sell stop should be placed at 135.20.

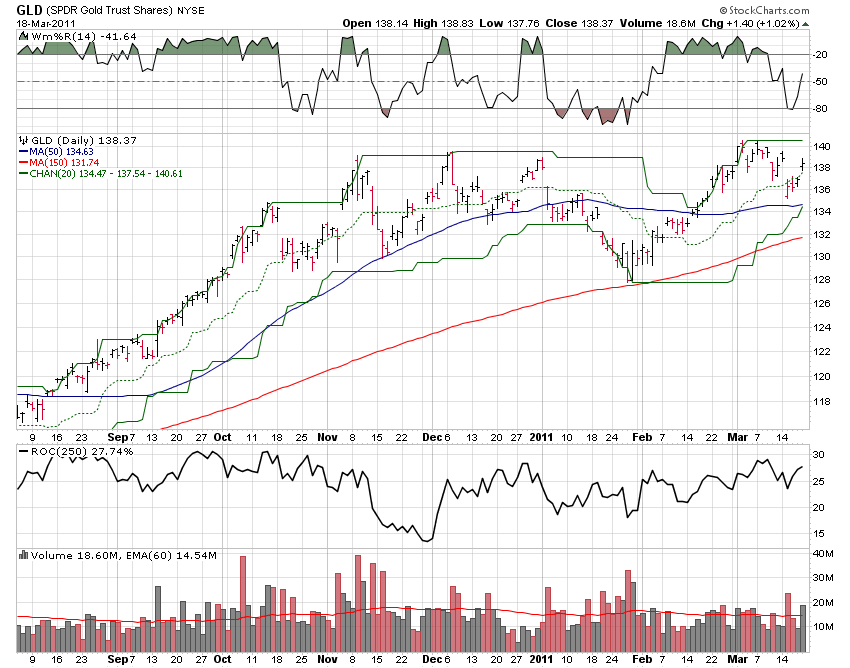

Gold also looks interesting, as though setting itself up to move higher:

Gold's sell-stop should be placed at 134.47.

Note that the last two are essentially bearish plays on the US Dollar.

- failure to rally up to the break-down point, then closing on the lows of the day when this area was approached;

- much lower volume on the two past up-days than during the prior 2 down days; this trend of higher volume on down days than up days (indicating distribution or selling) has been occurring since late February;

- failure to rally to the mid-point of the 4-week trading range (dotted green line below);

- failure to approach the 50-day moving average, and 6 closes below over the past 7 trading sessions.

Where in the world looks interesting right now? The Euro (FXE) has been breaking out after consolidating in the upper part of its trading range following a breakout at 134 in mid-January. The gap up is very bullish, although volume is not overly impressive. A key test will come in the 142 area, the site of a spike high and stalled rally in November (a bull trap):

FXE's sell stop should be placed at 135.20.

Gold also looks interesting, as though setting itself up to move higher:

Gold's sell-stop should be placed at 134.47.

Note that the last two are essentially bearish plays on the US Dollar.

No comments:

Post a Comment