S&P 500 Continues Rally But Possibly Overextended

I

generally don't like to try to call tops but to follow the trend until

it declares itself changed. That change has not happened yet, so I

remain long the market as it climbs a wall of worry sprinkled with signs

the economy is regaining strength.

The market tends to be strong around Memorial Day which is approaching, but weak during this 6-month period, so expect the unexpected during summer. The market is up almost 17% for the year which would be a very good year if we stopped now but unfortunately markets don't work that way - there will be so many stinker years that if you don't catch the 30-40% surges you will badly underperform. It ain't over 'til it's over and the market will tell us when it is tired and needs to consolidate or worse.

Solar

energy (TAN @ 25.90) is an interesting play. I watched it lurch up and

down, so it's more of a trade than an investment, but I bought the

pull-back in April following the penetration of the 20-day high. The

huge volume and spike high on April 8 could not be ignored - someone was

accumulating these shares and the pull back was on extremely light

volume. It's up 52% since my buy point in only 4 weeks! I wish I was

usually this smart or that I had taken out a larger position, but this

is a very exciting space with only a few players so when interest

builds, it has a tendency to explode. Sell stop at the 10 day trailing

low, currently 19.58, but likely to move higher very soon.

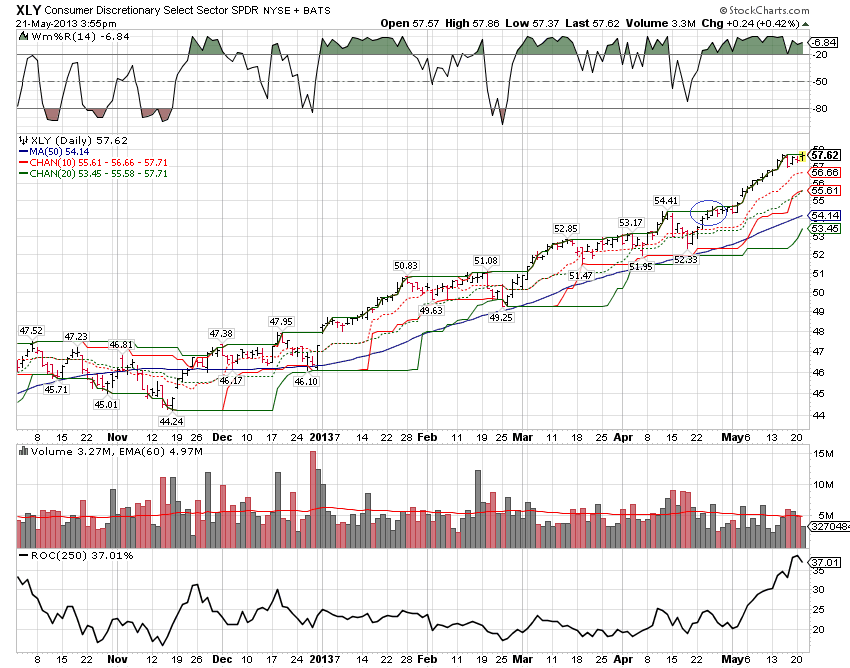

A

play on an economic recovery, XLY was behaving a bit better than the

SPY itself, so I moved back in after taking profits earlier during the

upmove. It is absolutely critical as a trader that you can buy back

shares at a higher price than you sold them and that you understand that

no price is too high to buy or too low to sell. Stop at trailing

10-day low currently 55.61.

I

owe this next trade to Barron's. During the Annual Roundtable, this

ETF was mentioned, a dollar-hedged Japan fund (so that it rises even if

the yen weakens relative to the dollar). It's been a fantastic success,

rising 63% since its November breakout with periods of consolidation,

occasional brief forays across a rising trendline, then nice orderly

consolidation and breakout. The fundamental story is fantastic: a new

Japanese government pledged to reflating the Japanese economy by

swelling the money supply. It seems to be working. Sell stop at 48.11

(10-day trailing low).

No comments:

Post a Comment